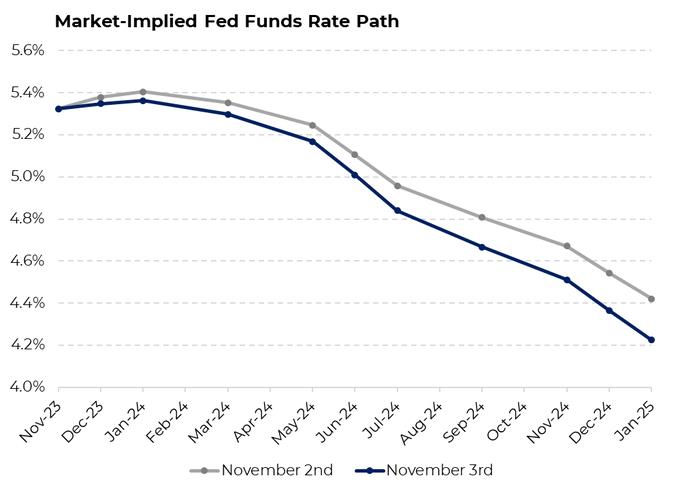

Wednesday’s unanimous Fed decision to keep rates unchanged was significant. This marked 2 consecutive meetings with no rate increase – the first “double pause” since early 2021 (before the current hiking cycle). Fed Chair Powell delivered the usual “warnings” that the Fed stands ready to increase rates if inflation perks up (aka “policy firming”). But, the comments seemed obligatory, more of the usual “Hawkish signaling.” There’s a growing consensus that if there is no increase at the next Fed meeting, they are “done” for this cycle. The bond rally started in the morning as Treasury Secretary Janet Yellin released the long awaited funding schedule for the next round of Treasury sales. Markets had been apprehensive in recent months about supply issues as growing budget deficits have expanded debt issuance. Markets cheered the release as the auction levels were lower than feared – spurring a “relief rally” as the uncertainty was eliminated. Powell’s “dovish tilt” at the meeting continued the rally. And don’t forget “the data” – this week has seen more signs of a softening economy: lower than expected job creation, a drop in manufacturing activity, productivity increases (lowering wage pressure), and an unexpected drop in labor costs. Today’s release of the October jobs report indicated a cooling jobs market: 150,000 jobs were created, less than half of the previous month’s gain. Significantly, the economy saw less broad based hiring as healthcare, government, and leisure/hospitality accounted for nearly all of the increases. This means that several sectors of the economy saw near zero job growth. The overall narrative is now focused on the Federal Reserve’s commitment to pausing rate increases as the economy cools with possible rate cuts occurring in mid-2024 (see chart above on future rate expectations yesterday and today). Stay tuned…

By David R. Pascale, Jr., Senior Vice President at George Smith Partners