-

PPI Data Continues The Narrative, 10 Year Treasury Down 60 Bps in 4 Weeks

November 17, 2022

After last week’s big rally on CPI, Tuesday’s PPI added to the “inflation has peaked” hopes. Core PPI rose 5.4% annually and was actually flat month over month (vs expectations of 7.2% and 0.3%), and well off the March 2022 highs. The services component declined by 0.1%, the first decline since November 2020. Consumer durable goods (apparel, electronics) prices continue to soften as inventories pile up. Retailers indicate that consumers are downsizing and/or changing buying habits towards more value oriented. Many are predicting lower-than-expected holiday sales (while travel demand is strong). Interestingly, consumer credit card balances saw its highest annual jump in 20 years. This could be a sign the red hot consumer demand over the past few years is unsustainable: pandemic savings are running low and credit card rates are rising with the Fed increases. Signs that the job market may be slackening: the seemingly non-stop hiring by big tech has abated with layoffs by industry leaders. Weaker demand and job market slack are critical to cooling off price pressures.

Fed officials are making it clear that the “job is not done” – Yesterday morning SF Fed President Daly remarked that “a pause is off the table.” But “slowing rate hikes” is on the table. The consensus is based on comments and futures markets: a 50 bps increase on December 14, followed by 25 bps at the February and March meetings. A pause at that point would put the “terminal” Fed Funds rate at 4.75%. Daly indicated that the target is “4.75-5.25%.” Then what? The Fed intends to hold that rate for a while and let the cumulative effects of the rate hikes take effect. Daly also pointed out that as the inflation rate declines, the delta between a stable Fed funds rate and inflation will increase and (hopefully) further diminish price pressures. Keeping up the narrative: Before the December meeting, we will get October PCE, November jobs, and CPI. Stay tuned…

By David R. Pascale, Jr., Senior Vice President at George Smith Partners

-

Bond and Stock Markets Rally on Cooler Than Expected CPI on “Pivot” Hopes

November 10, 2022

This morning’s October CPI report: Core CPI increased 0.3% for the month (0.5% expected), overall CPI is 0.4% (0.6% expected). Annual CPI is at 7.7% (7.9% expected and down from the June high of 9.1%). Relief rally: 10-Year Treasury dropped to 3.84%, down from a 4.12% opening; a big intraday move and below the psychologically significant 4.00% level. It’s interesting to note that the major fixed and floating rate lending indices are converging – 30 Day Term SOFR is 3.79%. The Dow jumped 850 points within hours. Fed futures “softened”: 85% chance of a 50 bp increase at next month’s meeting, 15% chance of a 75 bp increase. Yesterday it was 56% for 50 bps, 44% for 75 bps. One report does not “fix” inflation, but markets are ultra sensitive to trending data and anticipation. The rally is big as it assuages the fear that has emerged in recent weeks regarding the great Fed questions regarding the eventual terminal rate or peak rate: “How high and how long? Recent comments by Fed Chair Powell and other officials suggested the terminal rate may need to be 5.00% or higher to tame inflation. Today’s report provides a “hopeful path” to a lower peak and shorter time there.

Inside the numbers: Prices for “core goods” (homes, used cars, appliances, apparel) have been softening for months, while services costs have spiked. Today’s report indicated medical services prices fell 0.6%, benefitting from the “annual reset” methodology employed by the Labor Department. Another lagging indicator that should start showing softer price increases is shelter. Zillow, CoreLogic, RealPage and Apartment List have all indicated apartment rents (for new leases) softening nationwide over the past 2-3 months. It will take a couple more months for that to be figured into CPI, which counts “renters at large”- aka all tenants. Markets don’t want a repeat of the optimistic rallies as core CPI dropped steadily from April to June, but then leveled off in July and spiked in August and September- which sent rates soaring. Therefore, next month’s CPI report release on December 13, followed by the year’s final Fed meeting the next day is looming very large. Stay tuned…

By David R. Pascale, Jr., Senior Vice President at George Smith Partners

-

Fed Increases 75 bps, Powell Presser Squashes Rally, “Some Ways to Go”

November 3, 2022

First off, a 75 basis point increase for the 4th straight meeting put the Fed Funds rate at 3.75% – 4.00%, the highest since 2008. Prime Rate is 7.00%, 30-Year fixed rate home loans are about 7.30% and 30-Day Term SOFR is 3.79%. Markets rallied on “dovish” comments in the initial statement: “In determining the pace of future increases, the Committee will take into account the cumulative tightening…. (and) the lags with which monetary policy affects inflation.” Many economists note that Fed actions take time to work through the economy. A scenario where the Fed watches and waits while lagging indicators catch up could forestall economy-crushing excessive rate increases, aka the “soft landing.” Hopes of “the pivot rally” jumped as the 10-Year Treasury yield dropped to 3.98 from 4.06 and the Dow rallied over 300 points in 30 minutes… until Fed Chair Powell’s remarks and responses to questions. His opening remarks seemed like a direct response to domestic and international pressure on the Fed to ease off on rate increases. He reiterated that the Fed’s number one job is price stability and that a sustained healthy labor market depends on that stability. The irony in that statement is that fighting inflation will require more slack in the labor market, i.e. higher unemployment. It’s as if the Fed needs to “break employment to save it.” The phrase that really moved markets was: “It’s very premature to think about pausing”, which he repeated for emphasis. Powell recognized that conditions have already tightened in housing, business investments, and other rate-sensitive sectors. He noted that goods prices should have come down faster and that prices for services are rising significantly. Yesterday’s ADP report for September indicated robust hiring continues in the services sector – especially hospitality and leisure.

Future Direction: Powell indicated that the Fed might “slow the pace” of rate cuts in December and February. But the data point that really shook the markets was his response to the big questions which are: “How high?” and “How long?” – regarding the “terminal rate” or peak and how long before the next rate cut. It seems like the answers are “higher” and “longer.” Powell said that there is now “significant uncertainty” amongst Fed policymakers about the “ultimate level” for the Fed Funds rate. This follows recent comments by Fed President Kashkari that a “terminal rate” in the 5% range may be needed to battle core PCE inflation. Recent assumptions had the terminal rate at about 4.6% and hopefully peaking for a few months. Powell and the Fed are now setting expectations for a longer battle. Rhetoric such as “Some ways to go” and the recent mantra “Restrictive territory… for some time” drove the message home.

In the weeds: Powell discussed employment metrics he is closely following: job quits, vacancies and labor participation. The Fed is watching for any sign of slack in the labor markets. He also discussed softening rental rates and the inherent housing cost lag in the CPI statistics. CPI continues to count rental costs based on all lease payments, not just newly signed lease costs. This may understate the effect of Fed rate increases on housing costs for months. He noted that this lag is considered when reading the data. The rallies dissipated into negative territory as markets digested Powell’s remarks – the 10-Year jumped to 4.11% and the Dow dropped 1.5%. Stay tuned…

By David R. Pascale, Jr., Senior Vice President at George Smith Partners

-

“Extreme” Yield Curve Inversion Signals Recessionary Expectations, Bond Yields Drop

October 26, 2022

The 2 Year Treasury and the 10 Year Treasury inverted in July and have remained “out of balance” to this day. That inversion is often seen as a harbinger of a recession. Today, the 3-Month Treasury is higher than the 10 Year Treasury – this has occurred only 7 times since 1967. Markets may be saying that the Fed has raised rates too fast, without allowing for enough lag time to gauge the effects (which can be felt for up to a year after any given rate hike). This week has seen earning disappointments from tech companies as companies pull back on advertising. The Case-Shiller index indicated home price gains are dropping at the fastest pace on record as mortgage payments average 75% higher than last year. The Fed’s demand destruction strategy is “working.” Recent quotes from Fed policy makers indicate some concern over raising rates too quickly over the next few months. Bonds have rallied – after hitting a multiyear high of 4.32% last Friday. The 10 Year is down to 4.00% as of tonight’s close. The latest hopes are quantified in the futures markets – a 75 basis point increase is nearly assured at next week’s Fed meeting (94% probability), but the December meeting futures show a 63% chance of a 50 basis point increase, and 37% at 75. This Friday’s PCE report looms large as the final major inflation data point before next week’s meeting. Stay tuned…

By David R. Pascale, Jr. , Senior Vice President at George Smith Partners

-

10 Year Hits 4.15%, Highest Since July 2008

October 20, 2022

A perfect storm is continuing to hit treasury prices and therefore yields are rising. Markets study every data report hoping for some sign that inflationary pressures are easing/slowing/peaking, hoping for a “pivot” from the Fed. Recent economic data hasn’t provided that hope. The supply/demand metrics in the Treasury market are strained: record debt issuance and major buyers (Japan, China, Pension Funds) are buying less or sidelined. Also, most importantly, we are seeing heretofore untried Quantitative Tightening from The Fed. The central bank regularly purchased $80 billion per month during several extended periods since 2010, but is now selling Treasuries. The Fed was still purchasing Treasuries into March of this year. The process is now picking up as it took months for those recent purchases to “settle” – now the Fed is selling up to $95 billion per month. In fact, the Fed recently sold $37 billion in one week.

“Bid to cover” ratios are dropping in recent auctions, indicating fading demand. There are signs that liquidity in the Treasury market itself is starting to dry up, causing the normally calm Treasury Secretary Yellen to recently comment on her concerns. Recent Data: Last week’s CPI report continued the recent narrative that price increases are pivoting from goods to services. This is more concerning to the Fed as labor is a critical component of services. Example: travel is especially inflationary due to pent up demand for leisure combined with the return of business travel/conventions. Airline ticket prices and bookings are skyrocketing and the industry estimates there is a shortage of about one million workers in the segment. Note that apparel and appliances are seeing price and demand declines. Many retailers are overstocked as supply chains loosen and demand softens. Fed Speeches: Neil Kashkari referenced CPI reports in comments this week. He indicated that perhaps “headline” CPI has peaked but he is more concerned about core inflation (excluding food and energy). He indicated the Fed was resolute in its determination and if core inflation lingers into next year, commenting “But if we don’t see progress in underlying inflation or core inflation, I don’t see why I would advocate stopping at 4.5%, or 4.75%.” This caught markets attention – as the previously assumed “terminal rate” was about 4.25%-4.50%, and he’s talking about 5.0%. Fed Pivot Watch: Powell has made it very clear that the Fed is willing to tolerate unemployment and significant losses in stock markets without “blinking.” But recent developments like the British gilt crisis and Treasury market liquidity may be early indications of systematic financial risk which would (hopefully) be intolerable to the Fed. Stay tuned….

By David R. Pascale, Jr. , Senior Vice President at George Smith Partners

-

Check out Pascale’s Perspective on LinkedIn

October 12, 2022

-

A Tale of Two Demand Cycles

October 6, 2022

Is the Fed delivering the crushing demand shock that will stabilize prices and allow them to pause on the rate increases? The answers are “things are easing” for goods, and “not yet” for services. Last week’s PCE release indicated “core” inflation rose 0.3% monthly and 4.9% annually. Last month was 0% monthly and 4.7% annually. Markets reacted with a bond selloff, sending the 10 Year Treasury up to 3.83%. Spending on goods dropped 0.5% but spending on services jumped 0.8%. This could be seen as a “demand rotation” that will eventually result in an overall economic slowdown. This week’s reports continued the narrative: weak ISM manufacturing index: 50.9% (near contraction territory), construction spending down 0.7% month to month, and today’s ISM services index up to 56.7%.

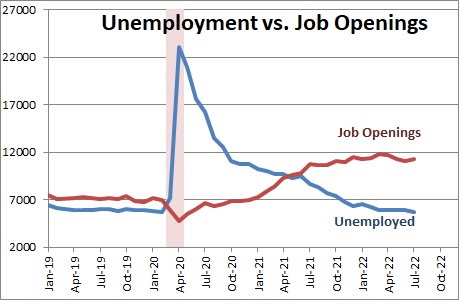

Today’s ADP report showed businesses added 208,000 jobs in September- surpassing the Dow’s estimation of 200,000 jobs. Note that goods producing industries (manufacturing, mining, natural resources) were down 29,000, but services (trade, transportation, utilities, business services) saw a gain of 147,000. The job increases aren’t necessarily inflationary, it’s the mismatch between open jobs and labor participation. That metric is easing – recent months saw a 2 to 1 ratio of open jobs for each unemployed American. That has dropped to 1.67 in September with increased labor participation and a drop in resignations. With the Fed having raised rates by 3.00% since March, it’s important to point out that the effects may be “lagging indicators.” There’s a case to be made for pausing rate increases to actually quantify the effects without going too far. From recent Fed speeches over the past few weeks, that isn’t happening. A 75 basis point increase in early November is basically a given, with speculation centering on the December and January meetings as slowing (25-50 basis points) or pausing. Stay tuned…

By David R. Pascale, Jr. , Senior Vice President at George Smith Partners

-

Bonds Rally Out of “Free Fall” On BOE Intervention

September 28, 2022

Bond yields spiked over the past week as global financial assets sold off. Stock markets here re-tested the June 2022 lows and the 10 Year Treasury jumped from 3.50% (at the time of the Fed meeting) up to 4.01% yesterday. A 4.0% 10 Year Treasury was last seen in mid-2008. The fear trade was in full effect as markets are getting the message that the “Fed Put” is off the table – the central bank will allow unemployment, market volatility, and higher unemployment in order to control rising prices.

The announcement of large tax cuts in Britain created market turmoil as the already weakened British pound plummeted in value, rating agencies issued harsh downgrades and Gilt bond yields spiked. The Bank of England surprisingly intervened strongly, buying up as much government debt as necessary to restore stability. The BOE statement: “Were dysfunction in this market to continue or worsen, there would be a material risk to UK financial stability. This would lead to an unwarranted tightening of financing conditions and a reduction of the flow of credit to the real economy.” Bond markets worldwide rallied as one of the “Big 7” central banks, who often discuss policy covertly or overtly during crises, stepped up in a crisis. Maybe this sets a new higher standard for monetary or fiscal intervention (“In case of financial meltdown, please break glass, otherwise you’re on your own”). The 10 Year Treasury dropped from 4.01% to 3.69% today, the biggest drop since 2020. Interestingly, the 10 Year British Gilt bond yield spiked to 4.5% before dropping to 4.05% today, which is very close to where the US 10 Year started the day. This week’s big data release is Friday’s PCE. The monthly core rate will be very closely watched, and its elements parsed. Stay tuned…

By David R. Pascale, Jr. , Senior Vice President at George Smith Partners

-

Fed Raises 75 bps And Is Not Done

September 21, 2022

Today’s 75 basis point increase in the Fed Funds rate was well telegraphed and the vote was unanimous. Today’s increase to a target rate of 3.00% – 3.25%, the highest since 2008, is the beginning of a period of restrictive monetary policy. The previous rate of 2.25% – 2.50% was considered the “neutral” rate, neither accommodative nor restrictive. The increase wasn’t really news, but the projections for “how much higher?” and “how long?” are significant. The terminal rate (peak) was anticipated to be about 3.8% in June. Today, the Fed dot plot and commentary put that rate at 4.6%. Futures markets are predicting another 75 basis point increase at the next meeting (November 2), with another 50 bps expected in December. That will take it to about 4.3%, on its way to the 4.6% terminal rate. The Fed “dot plot” predictions indicate the rate will remain there throughout 2023 with rate cuts starting in 2024. Compare that to June: a 3.25% year-end rate followed by a few more increases to 3.8% and rate cuts starting in the 2nd half of 2023.

In his remarks, Fed Chair Powell reiterated his concern that employment metrics are “out of balance” and contributing to inflation in an unprecedented manner. See the chart below, job openings are twice the amount of unemployed people. That ratio used to be about 1:2 pre-pandemic. Labor participation has taken a hit due to unprecedented social and behavioral changes in recent years. It will be difficult to tame inflation as long as this imbalance persists. Therefore, Powell is watching quits and upticks in labor participation very closely.

The Fed is abandoning its dual mandate, price stability, and full employment, in order to bring inflation under control. Jobs will be sacrificed on the altar of price stability. Quotes from today: “The chances of a soft landing are likely to diminish to the extent that policy needs to be more restrictive, or restrictive for longer,” and if there was any doubt, “Price stability is the responsibility of the Fed and serves as the bedrock of our economy… We think a failure to restore price stability would mean far greater pain (than higher unemployment)”. Rate increases are quite effective at driving down demand for big-ticket items (houses, cars, etc). The increases so far have put the 30-year fixed rate mortgage at 6.25% (January 1 it was 3.0%) and has contributed to the biggest drop in home sales since 2015. There are other signs that the economy is slowing down – possible “leading indicators” like FedEx’s dramatic drop in volume and dire outlook for next year, California’s drop in projected tax revenues, pauses in hiring from the once soaring tech sector, etc. 30-Day term SOFR is 3.08%, the 10 Year Treasury is at 3.56%, the highest since October 2008. Stay tuned…

By David R. Pascale, Jr. , Senior Vice President at George Smith Partners

-

Hot CPI Report Stokes Fears of “Entrenched” Inflation

September 14, 2022

Yesterday’s CPI report was expected to show moderating price increases led by falling energy prices. Instead, the 0.6% monthly increase in core prices took markets by surprise, with stock markets dropping dramatically, erasing recent rallies – which were largely based on softening inflation hopes. Price increases are broad-based – shelter costs, health care, restaurants, and travel are all experiencing high demand from a consumer base that has experienced a 6.7% increase in wages over the past year (that figure is the highest in 40 years). The narrative is changing: falling gas prices, improving supply chains, and lower shipping costs were expected to lead to lower prices. That’s not happening as relentless consumer demand keeps driving prices up. This is hardening expectations that the Fed will have to increase rates higher and longer to accomplish its desire to stifle demand. This was the last major piece of data before next week’s Fed meeting. The futures market is now pricing a 25% chance of a 100 basis point increase in the Fed Funds rate at next week’s meeting. The 10-Year Treasury spiked from 3.29% to as high as 3.46% yesterday, closing at 3.41% today. Piling on: A possible Railroad strike could massively disrupt supply chains as negotiations drag on towards a Friday deadline. Stay tuned…

By David R. Pascale, Jr. , Senior Vice President at George Smith Partners

-

Jobs Report Provides Hopes for “Soft Landing”

September 8, 2022

This last week shows how data-dependent markets have become, especially with a highly anticipated Fed meeting approaching. Last Friday’s August jobs report showed a softening in labor demand. This suggested that the labor supply/demand pressures could be slightly easing. Treasuries rallied on Friday in hopes the Fed wouldn’t have to increase rates as much as previously thought. The jury is still out on where the Fed’s “terminal rate” will end up in early/mid-2023. However, Tuesday’s hotter than expected economic reports from the services sector spooked markets as inflationary. The 10 Year yield spiked over 15 basis points up to 3.36% a recent high. Then, today’s Fed Beige Book survey indicated slowing growth and less inflationary pressures. This spurred another rally in treasuries – down to 3.27%. Fed President Lael Brainerd’s comments today were generally hawkish as per the Fed’s recent united message. She used the phrase “for some time” as she gauged how long rates would need to be elevated. But she also provided some hope as she acknowledged the risks of keeping rates high for too long. She indicated that the aggressive stance could “create risks associated with overtightening.” Interestingly, she also implied that the rapid increase in prices over the last 18 months has inflated margins for sellers of goods. She noted that the price consumers pay for cars has risen much faster in the last year than the price dealers pay wholesale. This implies there may be some room for prices to drop in certain sectors. Futures markets are pricing a 75 bp increase in the September 20-21 meeting. Stay tuned….

By David R. Pascale, Jr. , Senior Vice President at George Smith Partners

-

Fed Officials’ Stress Rates Will Be High “For Some Time”

August 31, 2022

Stock and bond markets have sold off every day since Fed Chair Powell’s remarks last Friday at the Jackson Hole Economic Policy Symposium. His eight-minute speech mentioned the word inflation over 40 times. Any hopes of the famous, or infamous, “Fed put” being invoked in this cycle were wiped out as he said, “While higher interest rates…will bring down inflation, they will also bring some pain.” He also set markets straight as to the “schedule” of upcoming rate hikes.

The 75 basis point increase in September is now at 70% likelihood in the futures markets. Markets expect increases of another 75 basis points total at the November/December meetings. That would bring the Fed Funds target rate up to 3.75% – 4.25% to open in 2023. That is right where several Fed officials are pegging the “Terminal Rate” – the highest rate hike in this cycle. Markets were assuming that the Fed would then “pivot” relatively quickly with rate cuts in response to a slowing economy. But Powell‘s comment on Friday sought to tamp down those expectations: “Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy.” NY Fed President John Williams chimed in on Tuesday in a live interview: “We’re going to…have restrictive policy for some time…This is not something we’re going to do for a very short period.” He chimed in on the Terminal Rate speculation, saying that “we do need to get real interest rates…above zero.” “Real interest rate” = the nominal interest rate minus inflation. Positive real interest rates would mean setting the Fed Funds rate above the inflation rate. Core PCE is at 4.6% today. Assuming inflation drops to about 4.0% early next year, Williams is estimating the terminal rate at about 4.00% – 4.25%. All of this “forward guidance” has therefore upended market expectations of the pace of rate cuts in 2023. This is causing the 10 Year Treasury to increase as it closed today at 3.21%. Of course, everything is data dependent – but officials are stressing that a change in this stated policy will require a sustained and unambiguous downward trend, not just “a few reports.” Stay tuned…

By David R. Pascale, Jr. , Senior Vice President at George Smith Partners

Don't Miss a Fact,

Sign Up for FINfacts!

FINfacts is a weekly newsletter highlighting recent financings and economic insights.

Subscribe Here