Today’s 75 basis point increase in the Fed Funds rate was well telegraphed and the vote was unanimous. Today’s increase to a target rate of 3.00% – 3.25%, the highest since 2008, is the beginning of a period of restrictive monetary policy. The previous rate of 2.25% – 2.50% was considered the “neutral” rate, neither accommodative nor restrictive. The increase wasn’t really news, but the projections for “how much higher?” and “how long?” are significant. The terminal rate (peak) was anticipated to be about 3.8% in June. Today, the Fed dot plot and commentary put that rate at 4.6%. Futures markets are predicting another 75 basis point increase at the next meeting (November 2), with another 50 bps expected in December. That will take it to about 4.3%, on its way to the 4.6% terminal rate. The Fed “dot plot” predictions indicate the rate will remain there throughout 2023 with rate cuts starting in 2024. Compare that to June: a 3.25% year-end rate followed by a few more increases to 3.8% and rate cuts starting in the 2nd half of 2023.

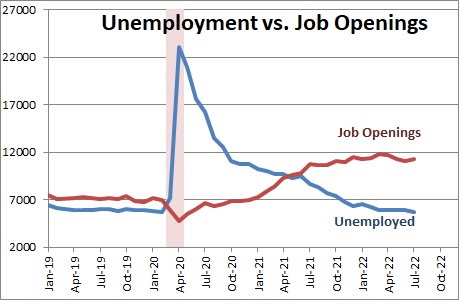

In his remarks, Fed Chair Powell reiterated his concern that employment metrics are “out of balance” and contributing to inflation in an unprecedented manner. See the chart below, job openings are twice the amount of unemployed people. That ratio used to be about 1:2 pre-pandemic. Labor participation has taken a hit due to unprecedented social and behavioral changes in recent years. It will be difficult to tame inflation as long as this imbalance persists. Therefore, Powell is watching quits and upticks in labor participation very closely.

The Fed is abandoning its dual mandate, price stability, and full employment, in order to bring inflation under control. Jobs will be sacrificed on the altar of price stability. Quotes from today: “The chances of a soft landing are likely to diminish to the extent that policy needs to be more restrictive, or restrictive for longer,” and if there was any doubt, “Price stability is the responsibility of the Fed and serves as the bedrock of our economy… We think a failure to restore price stability would mean far greater pain (than higher unemployment)”. Rate increases are quite effective at driving down demand for big-ticket items (houses, cars, etc). The increases so far have put the 30-year fixed rate mortgage at 6.25% (January 1 it was 3.0%) and has contributed to the biggest drop in home sales since 2015. There are other signs that the economy is slowing down – possible “leading indicators” like FedEx’s dramatic drop in volume and dire outlook for next year, California’s drop in projected tax revenues, pauses in hiring from the once soaring tech sector, etc. 30-Day term SOFR is 3.08%, the 10 Year Treasury is at 3.56%, the highest since October 2008. Stay tuned…

By David R. Pascale, Jr. , Senior Vice President at George Smith Partners