|

FINfacts™ XXIV – No. 277 | July 21, 2021

|

|

|

| Prime Rate |

3.25% 3.25% |

| 1 Month LIBOR |

0.09% 0.09% |

| 6 Month LIBOR |

0.15% 0.15% |

| 5 Yr Swap |

0.82% 0.82% |

| 10 Yr Swap |

1.30% 1.30% |

| 5 Yr US Treasury |

0.74% 0.74% |

| 10 Yr US Treasury |

1.30% 1.30% |

| 30 Yr US Treasury |

1.94% 1.94% |

|

|

|

Rate: 10-Year Swap Rate + 185 bps; 3.31% Fixed

Term: 10 Years

Amortization: 30 Year, 10-Year Interest-Only

LTV: 65%

Prepayment: Defeasance

Guaranty: Non-recourse except for “bad acts” and environmental

|

|

Transaction Description:

George Smith Partners successfully placed $30,000,000 in permanent fixed-rate financing for a 230,000 SF infill Southern California retail center amidst the COVID-19 pandemic. As a market-leading retail center near local economic and transit hubs, the Property’s mix of need-based and experiential tenants proved resilient. Capital providers continue to be hesitant in financing retail but were specifically concerned with California’s mandates that impacted the operation of non-essential businesses. As non-essential businesses and experiential tenants comprise a significant portion of tenancy, this posed significant challenges. These included the temporary closure of a movie theatre with less than one year of primary lease term remaining and a fitness center that vacated during the pandemic.

George Smith Partners secured 10 years of permanent financing with full-term interest-only in a financial environment that continues to be cautious towards retail. GSP negotiated competitive pricing at the desired level of proceeds and guided the deal to a successful closing.

|

|

|

|

Rate: 3.04%, Fixed

Term: 10 years

Amortization: Full-Term Interest Only

LTV: 65%

Lender Fee: Par

Prepayment: Defeasance

Guaranty: Non-recourse

|

|

Transaction Description:

George Smith Partners successfully placed $10,465,000 in non-recourse acquisition permanent financing for a 77,267 square foot, non-credit-grocer anchored retail shopping center in a transitory Pacific Southwest MSA. The tenant mix includes several national credit tenants along with local and regional stores (including the grocer anchor), all of which remained in-place during COVID-19. GSP was able to identify a lender who understood the complexities of retail in a post COVID environment. The non-recourse permanent loan was sized to 65% of purchase price, included 10years of interest-only payments at a fixed rate of 3.04% for 10 years. Lender fee is at par.

|

|

|

|

Rate: 7.90% Fixed

Term: 12 months, with Extension Options

Amortization: Interest Only

LTP: 40%

Prepayment: None

Guaranty: None

|

|

Transaction Description:

George Smith Partners successfully arranged a bridge acquisition financing for a single-tenant industrial building in Gardena, CA. The Property is 9,300 SF on an approximate 18,731 SF parcel. The previous owner occupied the space, and the building is now vacant. There was an existing environmental issue that limited the pool of interested capital providers. However, GSP leveraged its market expertise and relationships to identify a lender comfortable with the Property and Sponsor, who is a repeat client. GSP secured a 12-month, non-recourse bridge loan at 7.90% fixed with interest-only payments and no prepayment penalty. This will provide the Sponsor time to resolve the environmental issue, lease the Property and season it for permanent financing. The financing closed within 12 days of term sheet issuance.

|

|

|

|

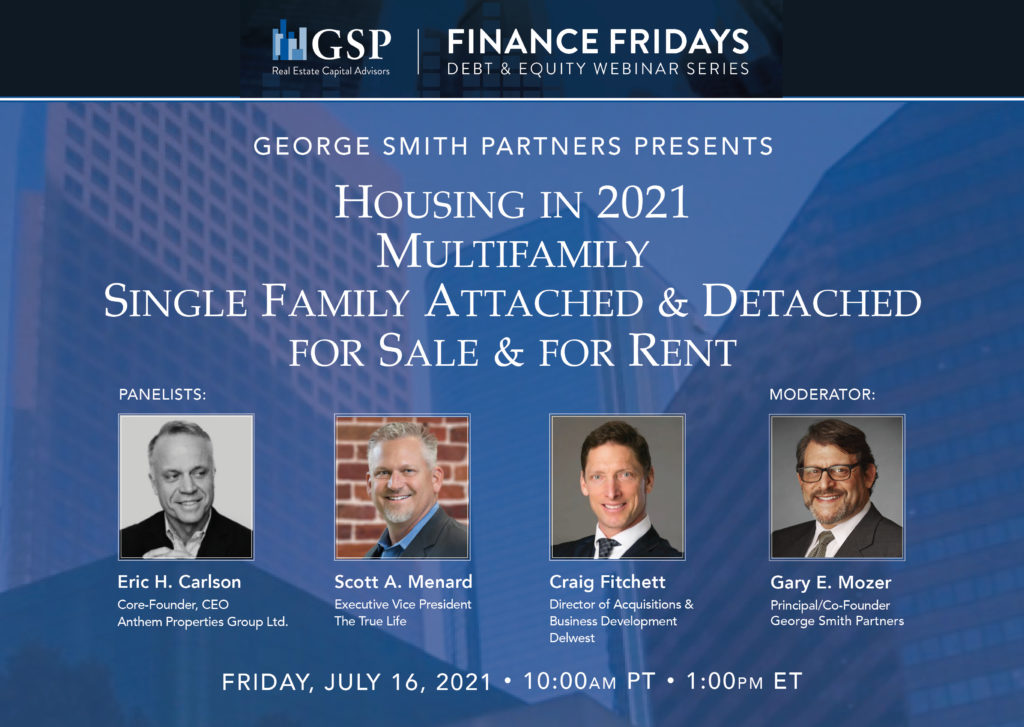

Did you miss the latest episode of Finance Fridays “Housing in 2021”?

Gary Mozer, Principal/Co-Founder at George Smith Partners moderated the discussion about Multifamily, Single Family Attached & Detached and For Sale and For Rent Housing.

Click here for the webinar replay

|

|

|

Stock markets plunged along with Treasury yields on Monday before rebounding yesterday and into today. The 10 year T dropped to 1.14% from 1.30% on Monday as concerns mount about rising Covid cases. The “June narrative” whereby a highly vaccinated society reopens and economic activity booms accordingly is being replaced by concerns about the highly contagious Delta variant. The recovery may be volatile and asymmetrical among regions and sectors. Interestingly, when the 10 year T hit 1.14% on Monday, it was in the middle of the pandemic low (0.50%, July 2020) and high (1.77%, March 2021). For now, inflation fears seem to be ebbing. The next 2-3 months will be fascinating as the “base effects” subside, supply chains return to near normal, and CPI/PCE statistics start to increasingly matter to markets. Next week’s Fed meeting may be the last meeting that Fed officials can claim price increases are “transitory”. Also next week: CPI, core CPI, and PCE announcements. Stay tuned. By David R. Pascale, Jr. , Senior Vice President at George Smith Partners

|

|

|

If you have an inquiry regarding George Smith Partners’ commercial real estate financing, please contact your GSP representative or Todd August, Chief Operating Officer at (310) 867-2995 or taugust@gspartners.com

|

|

Constellation Place

10250 Constellation Blvd., Ste. 2700

Los Angeles, CA 90067

|

|

|

|

© 1999 - 2024 George Smith Partners, Inc. DRE # 00822654 FINfacts is an ePublication of George Smith Partners, Inc. For Promotional Purposes Only. All Rights Reserved.

|

|

|

|

Hi, just a reminder that you're receiving this email because you have expressed an interest in George Smith Partners. Don't forget to add finfacts@gspartners.com to your address book so we'll be sure to land in your inbox!

|

|