|

KIRISITS’ CORNER

No Free Lunch With Interest Rate Caps

Any borrower that has closed a bridge loan knows that an interest rate cap is required. A typical requirement for a bridge loan with a 3 year initial term looks like this:

At Closing, Borrower shall enter into an interest rate cap agreement with a counterparty

reasonably acceptable to Lender, in form and substance acceptable to Lender, for a term of

three (3) years and with a one-month CME Term SOFR strike price not to exceed

2.00%.

For the past several years, the market has been in a low and stable interest rate environment, and borrowers had little problem paying for a cap. Much has changed in the past 3 months. Due to interest rate volatility, the price of caps has exploded. The cost of a cap on a $10MM loan was about $23,000 at the end of 2019 but is now at least $173,000 (depending on the stipulations).

Source: Chatham calculator for $10MM notional loan

Several borrowers have asked us to find a way to reduce the cost of the cap. Usually, the easiest decision is changing the term. In nearly all cases, GSP has managed to get the initial term of the cap reduced to 2 years, with the requirement that the borrower purchase a new 1-year cap when the term expires. In the table above, reducing the term from 3 years to 2 years saves $124,000 in closing costs. Sometimes, the borrower can even refinance or sell within 2 years and will not have to renew. However, there is still risk with this change. The cost of renewing the cap in 2 years is unknown and it may be more expensive than anticipated.

With regards to the strike price, it is possible to increase the strike from 2.00% to 3.00%, but that comes at a tradeoff. The 2.00% strike price has a higher upfront cost, but it begins to provide a benefit as soon as SOFR goes above 2.00%. On the other hand, the 3.00% strike has a lower upfront cost, but does not provide a benefit until SOFR goes above 3.00%. Theoretically, SOFR could be stuck between 2% and 3% and the borrower will never hit the cap. The odds of these scenarios are factored into the price and thus there is “no free lunch” when choosing a strike price.

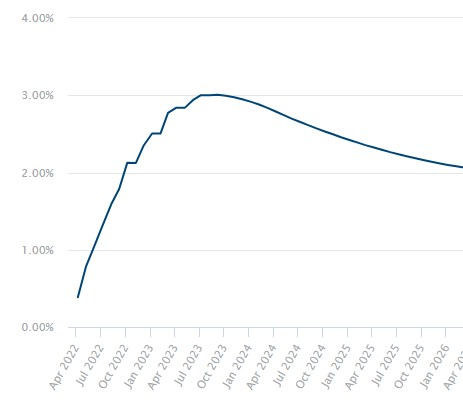

In fact, the forward SOFR curve currently predicts that the rate will hit 3.0% in about a year, but this will inevitably change as the Fed updates it guidance.

Source: Chatham

Another option is to enter a floating-to-fixed interest rate swap to lock in the rate. The borrower can fix the loan, but the tradeoff is that the fixed rate will be much higher than the initial floating rate. For example, a floating rate loan that starts at 3.50% could be fixed by paying an additional 2.50% swap rate, resulting in a fixed rate of 6.00% throughout the term of the loan. These types of swaps are highly customized and complex. The borrower should only enter a swap if they believe that the index rate will increase very quickly and by a large amount. By Matt Kirisits, Vice President at George Smith Partners

If you have an inquiry regarding George Smith Partners’ commercial real estate financing, please contact your GSP representative or Todd August, Chief Operating Officer at (310) 867-2995 or taugust@gspartners.com

|