|

FINfacts™ XXIV – No. 289 | October 13, 2021

|

|

|

| Prime Rate |

3.25% 3.25% |

| 1 Month LIBOR |

0.09% 0.09% |

| 6 Month LIBOR |

0.16% 0.16% |

| 5 Yr Swap |

1.17% 1.17% |

| 10 Yr Swap |

1.58% 1.58%

|

| 5 Yr US Treasury |

1.07% 1.07%

|

| 10 Yr US Treasury |

1.54% 1.54%

|

| 30 Yr US Treasury |

2.10% 2.10% |

|

|

|

Rate: L+500

Term: 3 Years

LTV: 70% LTC, 65% Loan to Stable Value

Guaranty: Non-Recourse

|

|

Transaction Description:

George Smith Partners successfully placed $22,070,000 in bridge financing for a vacant, 34,000 SF office building in West Los Angeles. Considering the negative effects of COVID on the office leasing market, capital providers were hesitant in financing a vacant building. The Sponsor envisioned two potential business plans: leasing the building to a single user or a mixed-use scenario where the ground floor would be converted to restaurant/retail. Supported by a strong Sponsor and backed by collateral with a high parking ratio centrally located in Los Angeles’s premier office market, GSP found a lender willing to finance both scenarios. The loan held back funds for tenant improvements, leasing commissions and capital expenditures. This provided flexibility to cope with the uncertainties of the COVID-era office leasing market. With optionality and competitive pricing, GSP negotiated a flexible loan agreement at the desired level of proceeds. Although COVID has turned office into a difficult asset class to finance, GSP guided the deal to a successful closing.

|

|

|

|

Rate: L + 925 w/ 0.50% Libor floor

Term: 18 months

LTC: 75%

Prepayment Penalty: 12 months min. interest

Guaranty: Non-Recourse

|

|

Transaction Description:

George Smith Partners successfully advised on a $8,700,000 construction financing for the development of a 5-story, 23,654 square feet office building located in Denver, CO. The Sponsor’s combined 30-year real estate development experience in conjunction with their partner’s 40+ years of commercial leasing experience was key to securing the financing. GSP worked through several strategies with the Sponsor to source the right non-recourse financing terms for the ground-up ‘spec’ office transaction. Ultimately, GSP successfully obtained several highly reliable financing options, and the Sponsor selected a lender with exceptional terms.

The Sponsor projects a timely delivery for completion of the project in late 2022 and intends to market the lease of the building during design and construction. With the robust economic recovery from the COVID-19 pandemic, the greater Denver metropolitan area is experiencing rapid job growth and expansion, increasing the demand for office spaces.

|

|

|

|

|

Transaction Description:

George Smith Partners placed a $2,100,000 Co-GP investment on a proposed 250-unit multifamily development site in Phoenix, AZ. The land is under contract with entitlements completed and development approvals underway. The Project will be a resort-style community comprised of studio, 1, 2 and 3-bedroom units in a farm-style design offering a clubhouse amenity, fitness gym, outdoor recreational areas as well as attached and detached garages. The Project is located on a main intersection in one of Phoenix’s emerging suburban villages with 15-minute access to downtown via the recently opened Loop 202. This area is served by over 300,000 square FEET of national credit big box, grocery anchored and service retail. The Co-GP investment will allow the Sponsor to complete the predevelopment phase to shovel ready. It will also allow the Sponsor/Developer to collect 100% of its developer and construction management fees. The estimated project cost is $60,000,000. George Smith Partners has been exclusively engaged to arrange the entire capital stack for the next phase of the Project.

|

|

|

|

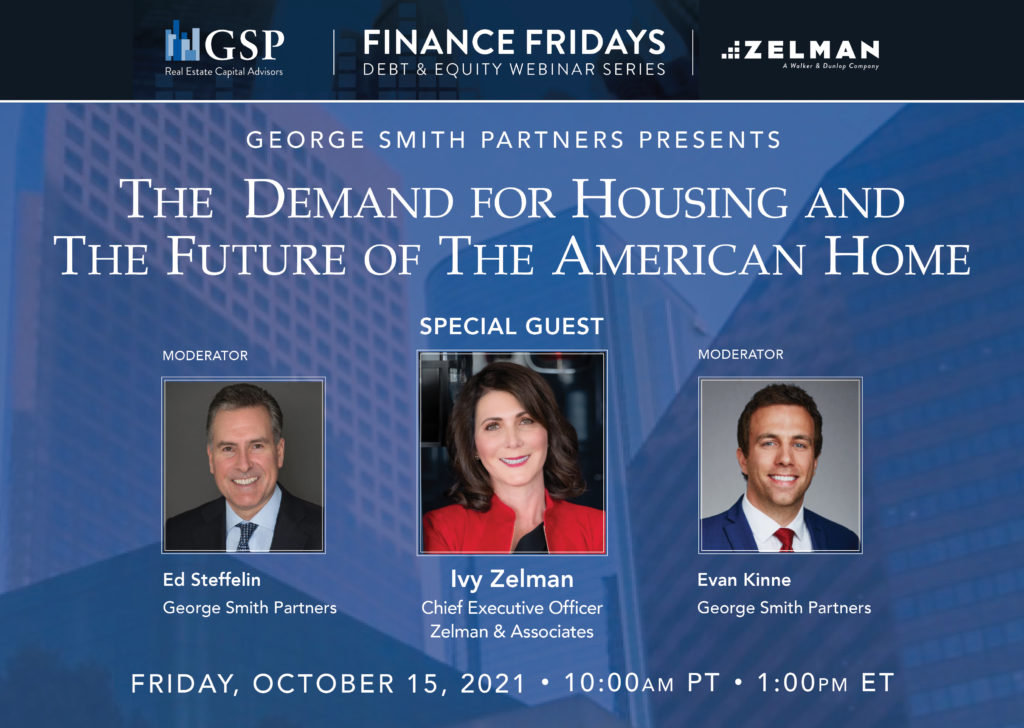

Please join us this Friday for The Demand for Housing and The Future of the American Home webinar featuring Ivy Zelman, CEO of Zelman Associates. Ivy is widely respected for her unbiased, in-depth research, insightful analysis, and actionable advice about the housing market and related sectors. Evan Kinne, SVP and Ed Steffelin, SVP at George Smith Partners will discuss the below topics with Ivy.

- Effects of the legislative agenda on housing

- Affordability and what that looks like in the years ahead

- Single family rentals – supply and demand dynamics

- Gimme Shelter: Hard Calls & Soft Skills From a Wall St. Trailblazer

Register Here: The Demand for Housing and The Future of the American Home

|

|

|

After all the months of prepping markets, “telegraphing” and promising almost unprecedented transparency on the subject, the taper announcement and structure has arrived. Interestingly, it was communicated by a release of Fed Minutes, not an official meeting date with a Powell appearance.

Summary of the Minutes and Commentary from Fed Officials: The “next meeting” (November 2-3) is an appropriate time to announce tapering. Bond purchases are now $120 billion per month ($80B treasuries, $40B mortgage backed securities). The purchases will be cut at a rate of $15 billion per month. This will result in an 8 month tapering period, completed by July 2022. It looks like the markets were ready, the 10 year actually dropped about 7 bps to 1.54%. Hopefully the market will be able to price future rate risk without a lot of volatility. What comes after tapering? The runway will be clear for a rate increase in 4Q 2022 (the futures market indicates this is likely). Stay tuned. By David R. Pascale, Jr. , Senior Vice President at George Smith Partners

|

|

|

If you have an inquiry regarding George Smith Partners’ commercial real estate financing, please contact your GSP representative or Todd August, Chief Operating Officer at (310) 867-2995 or taugust@gspartners.com

|

|

Constellation Place

10250 Constellation Blvd., Ste. 2700

Los Angeles, CA 90067

|

|

|

|

© 1999 - 2024 George Smith Partners, Inc. DRE # 00822654 FINfacts is an ePublication of George Smith Partners, Inc. For Promotional Purposes Only. All Rights Reserved.

|

|

|

|

Hi, just a reminder that you're receiving this email because you have expressed an interest in George Smith Partners. Don't forget to add finfacts@gspartners.com to your address book so we'll be sure to land in your inbox!

|

|