|

FINfacts™ XXIV – No. 270 | June 2, 2021

|

|

|

| Prime Rate |

3.25% 3.25% |

| 1 Month LIBOR |

0.09% 0.09% |

| 6 Month LIBOR |

0.17% 0.17% |

| 5 Yr Swap |

0.89% 0.89%

|

| 10 Yr Swap |

1.57% 1.57%

|

| 5 Yr US Treasury |

0.79% 0.79%

|

| 10 Yr US Treasury |

1.59% 1.59%

|

| 30 Yr US Treasury |

2.30% 2.30% |

|

|

|

Term: 10-Years

Rate: 3.61%

Lender Fee: .75%

Amortization: 30 Years, I/O-Years 1-5

LTV: 58%

Prepayment: Defeasance

Guaranty: Non-Recourse

|

|

Transaction Description:

George Smith Partners secured a $23,954,000 loan for a 240-unit market rate, multifamily property in Western United States. While not deed restricted, the Property is marketed only to seniors. The first mortgage has a 10-Year term at a 3.61% fixed rate, 30-year amortization, with 60 months of interest only.

Despite a requirement to pay defeasance to prepay an existing fixed rate loan two years prior to maturity, the Sponsor was able to generate over $5 million of net cash proceeds and reduce the borrowing rate by over 50 bps. The loan was priced in February when interest rates were particularly volatile and increasing rapidly. GSP negotiated a spread of 2.31% as well as having the Lender agree to do a forward index lock on the 10-year Treasury at 1.30%. When the loan closed, the 10-year Treasury had increased 43 bps to 1.73% which would have yielded an all-in rate of 4.04%. The higher rate would have significantly reduced the net proceeds and made the refinance non-economic; but, due to the early index lock, the all-in rate was effectively locked at 3.61% with the rate held though closing.

|

|

|

|

Rate: Prime plus 125 bps. 5% floor.

Term: 2 years plus 2-year mini perm

LTC: 60%

Amortization: Non

Guaranty: Non-Recourse except for standard carve outs, “bad acts”, and environmental

|

|

Transaction Description:

George Smith Partners successfully placed a $12,130,000 ($247k/unit) construction loan to construct 49 townhomes for rent. The loan is floating rate at Prime plus 125 bps. with a floor at 5% and has a 2-year term with a 2-year mini perm extension. The Property will cater to higher income renters in the affluent Arcadia area of Phoenix, AZ. GSP leveraged its extensive expertise in the single-family rental sector to source options for the Sponsor who is a top tier private equity firm that has entered the build to rent space with several transactions.

The Project targeted a higher end renter (“renter by choice”) that wanted to live in an excellent neighborhood. Many other build to rent projects are targeted to a more affordable and “renter by necessity”. This higher end strategy was a bit more difficult to market, but the Project had strong sponsorship and the Lender had familiarity with the desirability of the specific neighborhood.

|

|

|

|

Rate: 7.90% Fixed

Term: 12 Months, with Extension Options

Amortization: Interest Only

LTP: 57%

Prepayment: None

Guaranty: None

|

|

Transaction Description:

George Smith Partners successfully arranged bridge acquisition financing for a single-tenant industrial building in Wilmington, CA. The Property is 3,950 SF on an approximate 8,640 SF parcel. The previous owner occupied the Property, and the building is now vacant. GSP secured a 12-month, non-recourse bridge loan at 7.90% fixed with interest only payments and no prepayment penalty. This will provide the Sponsor time to lease the Property and season it for permanent financing. The financing closed within two weeks of term sheet issuance.

|

|

|

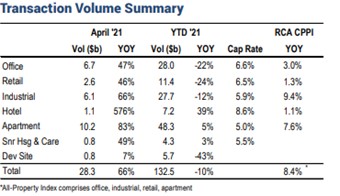

CRE Transactions Show Strong Year-Over-Year Growth

US commercial real estate transaction data through April 2021 is now available, allowing for year-over-year comparisons to the first full month of the imposed economic shutdown. Not surprisingly, the data reflects a massive increase. April month-end total volume of $28.3B equates to 66% YOY growth.

Source: Real Capital Analytics

While numerous lenders took a wait-and-see approach in the early months of the pandemic, GSP remained focused on arranging capital to serve our client’s needs. Through a combination of both fiscal and monetary policies, the GSEs continued to offer favorable terms in line with their mission statements of providing stability across the housing industry. Transactions closed during Q2 2020 were comprised of approximately 90% multifamily permanent debt.

By Q3 2020 a significant amount of liquidity had returned to the debt capital markets. GSP was again arranging higher volume of both bridge and construction loans in addition to financing retail, office, and land. One specific financing vehicle that dramatically expanded in response to pandemic related financial hardships was aggressive multifamily bridge programs for recently completed projects. Lenders replaced construction loans and provided borrowers with additional time to complete lease-up and stabilize cash flows to meet perm guidelines. Many of those properties are now nearing full stabilization and GSP is sourcing interest-only perm debt with rates in the low 3s.

Rates have remained persistently low even amidst growing concerns over near-term inflation. A critical question is whether inflation will prove to be transitory. The concern is that the current spike in the Consumer Price Index (4.2% as of April) persists through Q3 2021, which could potentially push the Fed to change course on their dovish stance and begin raising interest rates.

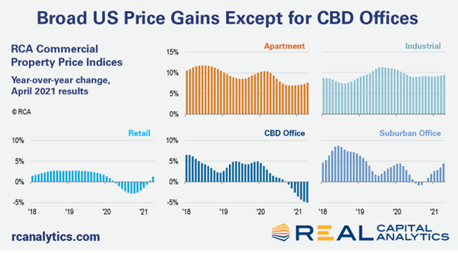

As the economy continues to expand, multifamily and industrial remain the preferred asset classes of investors and lenders alike. Cap rates for multifamily did not increase during the pandemic; there was a large spread between the bid and the ask and owners simply refinanced if they could not secure desired pricing. In contrast, cap rates for CBD office properties are increasing. Nationwide, CBD office cap rates are 5.6%, 20 bps higher than the pre-pandemic lows. As of Q1, office vacancy is a record 18.2% and nearly every large city is experiencing negative net absorption of office space. Per RCA, central business district office properties were the only asset class to show year-over-year price declines. Multifamily, industrial, and even suburban offices saw price gains. Once of the most actively debated topics is whether occupancy levels and prices for CBD office properties will recover, and how quickly that will take place.

If you have an inquiry regarding George Smith Partners’ commercial real estate financing, please contact your GSP representative or Todd August, Chief Operating Officer at (310) 867-2995 or taugust@gspartners.com

|

|

Constellation Place

10250 Constellation Blvd., Ste. 2700

Los Angeles, CA 90067

|

|

|

|

© 1999 - 2024 George Smith Partners, Inc. DRE # 00822654 FINfacts is an ePublication of George Smith Partners, Inc. For Promotional Purposes Only. All Rights Reserved.

|

|

|

|

Hi, just a reminder that you're receiving this email because you have expressed an interest in George Smith Partners. Don't forget to add finfacts@gspartners.com to your address book so we'll be sure to land in your inbox!

|

|