|

FINfacts™ XXIV – No. 218 | May 20, 2020

|

|

|

| Prime Rate |

3.25% 3.25% |

| 1 Month LIBOR |

0.17% 0.17%

|

| 6 Month LIBOR |

0.59% 0.59% |

| 5 Yr Swap |

0.39% 0.39%

|

| 10 Yr Swap |

0.68% 0.68%

|

| 5 Yr US Treasury |

0.34% 0.34% |

| 10 Yr US Treasury |

0.69% 0.69%

|

| 30 Yr US Treasury |

1.41% 1.41% |

|

|

|

Rate: 4.75% Fixed

Term: 1 + 5 (12 Months Construction, then 5 Years Perm)

Amortization: 3 Years I/O then 30 Years Amortization

LTC: 80%

Guaranty: Completion Guarantee

|

|

Transaction Description:

George Smith Partners successfully secured a high leverage $21,700,000 non-recourse, Construction-to-Perm loan to develop a six-building, 966-unit, climate controlled, Class-A self-storage facility near Stevenson Ranch in the Santa Clarita Valley, California.

Challenges:

The Sponsor, while very experienced in other asset classes, engaged GSP to source the full capital stack (debt, equity and carve-outs guarantor) for his first self-storage project. New Building & Safety codes that took effect in 2020 resulted in increased costs and delays. In order to obtain certified pads by the end of 2019, the entitlements in-place had to be vetted and the horizontal work needed to start prior to securing construction financing. The impacts of Covid-19 resulted in multiple delays from subcontractors, County inspectors, and in pulling permits due to County offices being closed.

Solutions:

GSP was able to source an investor from its pool of strong relationships who provided the equity. GSP focused on the market necessity for storage units in the desirable and growing community of Santa Clarita Valley, and successfully negotiated an agreement with Public Storage to operate the facility. GSP identified a capital provider to not only extend the financing commitment multiple times, but also to execute a structured, non-recourse, low-rate loan with the same terms agreed upon prior to Covid-19.

|

|

|

|

Rate: 4.59%

Term: 5 Years

Amortization: 30 Years

Prepayment: 3%, 1%, 0%

|

|

Transaction Description:

George Smith Partners secured $1,690,000 in Freddie Mac permanent financing for the acquisition of a stabilized 72-unit multifamily property located in Killeen, Texas. The Property is located four miles southeast of Fort Hood, the largest active-duty armored post in the U.S. military, occupying more than 218,000 acres of land in Bell and Coryell Counties.

Challenges:

As GSP went into application, the world was entering into the COVID-19 pandemic. Most lenders had either stopped lending or become much more cautious. Most agency lenders require Borrowers to have a track record with multiple projects before they will be considered for a Freddie Mac or Fannie Mae loan. In this case, the Sponosr was a first-time agency borrower. To make it even more challenging, the Property was in a small market with a high concentration of military personnel and the Sponsor required the ability to have prepayment flexibility.

Solution:

GSP used its relationship with a capital provider who closed multiple loans with our firm. GSP recently closed a loan in a similar small market and we were confident that they would understand the demographics and market characteristics. For this type of financing, the Lender’s typical structure is to offer a 10-year term with Yield Maintenance. Thanks to GSP’s long-standing relationship with this Lender, we were able to secure an attractive rate, high leverage, and a step-down prepayment of 3,1,0,0,0 on a 5-year term. The new capital allows the Sponsor to expand their Texas Multi-Family portfolio.

|

|

|

|

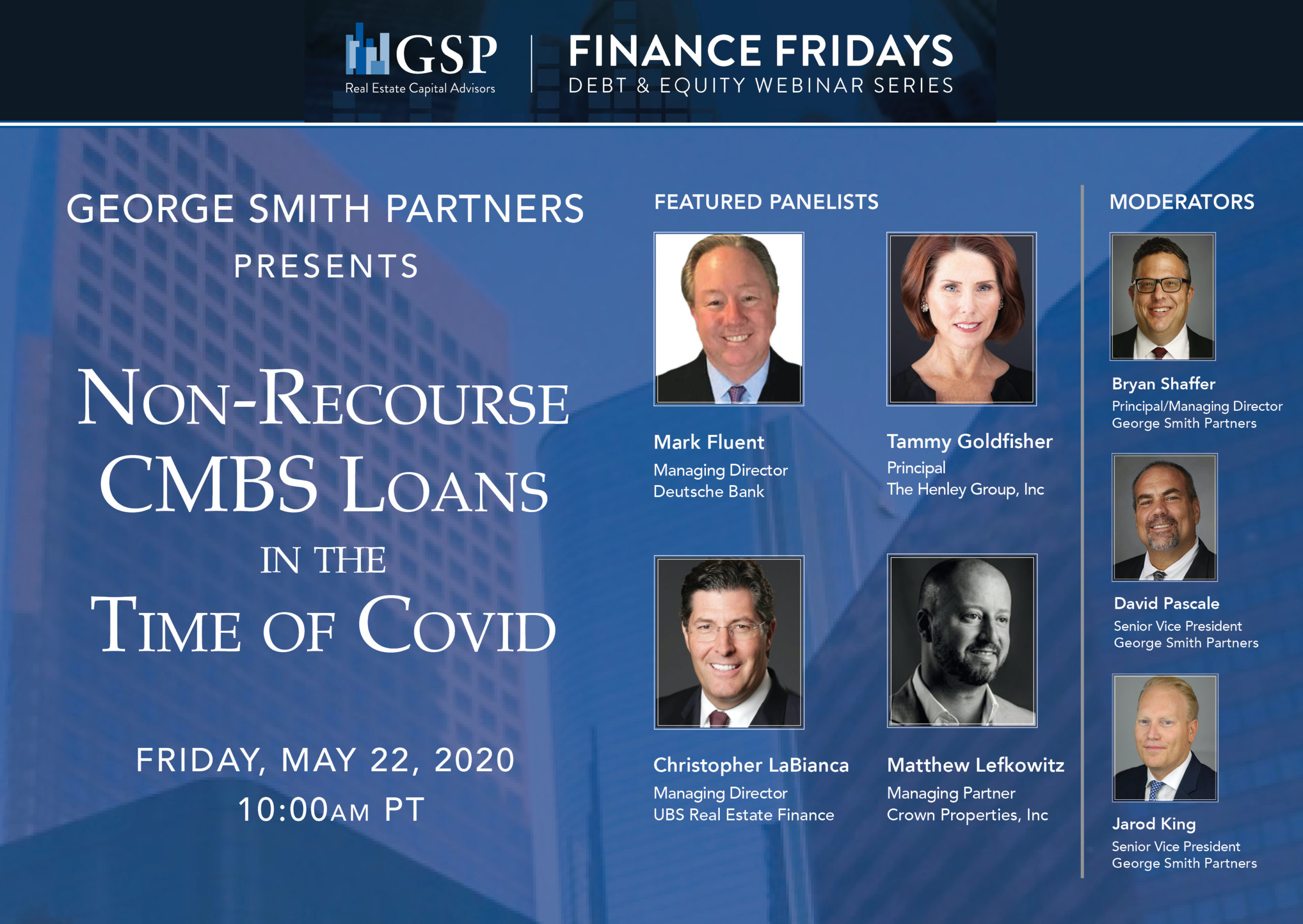

WEBINAR

Finance Fridays with GSP: Non-Recourse CMBS Loans in the Time of COVID | Friday, May 22, 2020 | 10:00 am PT

REGISTER HERE

|

|

|

George Smith Partners is currently placing non-recourse bridge financing up to $20,000,000 for all major property types nationwide. This balance sheet lender offers up to 70% LTC for loans with terms 3+1 each extension option at 0.5%. Pricing is L+450-550 on a 0.5% floor with 0% in and 1% to 1.5% exit fee. They can close in 30 days from application.

|

|

|

There is some level of reopening in all 50 states this week. Monday’s hopeful news about a potential vaccine rallied stock and debt markets. The rally may have been an overreaction, time will tell. But, both news items illuminate the situation. Various phases of restarting business is under way, with new guidelines that hopefully will prevent a second wave of infections. We are entering another “new normal” of “cautious commerce” until a medical solution is reached. Economists, politicians, policy makers, business leaders and all of society are grappling with the obvious questions about the speed and shape of the recovery. These issues were very starkly raised in yesterday’s fascinating appearance before the Senate of Fed Chair Powell and Treasury Secretary Mnuchin. First off, the CMBS market was mentioned multiple times. Senators asked about “empty malls” and the securitized loans that back them. Powell was asked by Senator Tim Scott, “Why aren’t you doing more for CMBS?” Senator Ben Sasse asked if the Fed was taking “Too much risk in CMBS?” Powell said he is supporting and monitoring CMBS, which is an “important market” but “not every problem can be addressed”. The Fed is only buying AAA bonds and he doesn’t anticipate any haircuts. After the highly watched 60 Minutes appearance, Powell continued to challenge Congress. He reiterated the tough road for the economy ahead and a potential slowing recovery. Powell called on Congress for further stimulus and reiterated the limits of the Feds power. It comes down (again) to monetary policy and fiscal policy. With the major shock to the economy over the past few months, many businesses (small and large) and governmental entities (states and cities) are reeling. If the Great Recession was basically a massive credit crisis, today’s issue is a solvency crisis. Powell reiterated that the credit markets are flush with liquidity and there is money to lend. But, many potential borrowers are not creditworthy and/or insolvent. Powell has clearly stated many times that the Fed cannot “make grants”. That puts the pressure back on Congress to provide fiscal aid in order to help with solvency. These policies are controversial as the terms “bailout” and “moral hazard” are likely to come up. Stay tuned. By David R. Pascale, Jr. , Senior Vice President at George Smith Partners

|

|

|

If you have an inquiry regarding George Smith Partners’ commercial real estate financing, please contact your GSP representative or Todd August, Chief Operating Officer at (310) 867-2995 or taugust@gspartners.com

|

|

Constellation Place

10250 Constellation Blvd., Ste. 2700

Los Angeles, CA 90067

|

|

|

|

© 1999 - 2024 George Smith Partners, Inc. DRE # 00822654 FINfacts is an ePublication of George Smith Partners, Inc. For Promotional Purposes Only. All Rights Reserved.

|

|

|

|

Hi, just a reminder that you're receiving this email because you have expressed an interest in George Smith Partners. Don't forget to add finfacts@gspartners.com to your address book so we'll be sure to land in your inbox!

|

|