|

FINfacts™ XXIV – No. 156 | February 27, 2019

|

|

|

| Prime Rate |

5.50 5.50 |

| 1 Month LIBOR |

2.48 2.48

|

| 6 Month LIBOR |

2.69 2.69 |

| 5 Yr Swap |

2.57 2.57 |

| 10 Yr Swap |

2.70 2.70 |

| 5 Yr US Treasury |

2.51 2.51 |

| 10 Yr US Treasury |

2.69 2.69 |

| 30 Yr US Treasury |

3.01 3.01 |

|

|

|

|

Transaction Description:

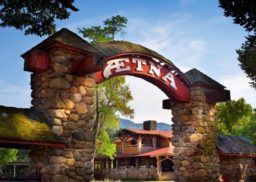

George Smith Partners secured $29,000,000 for the acquisition of the Aetna Springs Resort, a rare historic site in Napa County, CA. The Aetna Springs Resort dates back to the 1870’s and is the last available parcel entitled for resort development in the Napa Valley area. Upon completion, the Property will be expanded to include 88 luxury suites, 16 adjacent estate lots averaging 50-acres each, and a permitted winery.

Challenges:

While investors were intrigued by the location of the Resort, the 3,100 acres of land included 2,390 acres of land that was not adjacent to the Resort. Many investors shied away from the deal given the complexity of the collateral. Other investors were more conservative towards land loans given our point in the cycle.

Solutions:

George Smith Partners located an investor who understood Napa hospitality and understood the value in a new resort. They also took the time to understand the land/vineyard component of the collateral and were able to provide a structure that gave the Sponsor time to sell the non-adjacent collateral in an effort to maintain focus on the resort component.

|

|

|

|

Proceeds: $9,390,000

Rate: 4.46% fixed for 5 years, then floating at 6M LIBOR + 3.25%

Term: 20 years

Amortization: 2 years Interest Only followed by 30 year amortization

Prepayment Penalty: 5,4,3,2,1,0

LTV: 65%

DCR: 1.2x

|

|

Transaction Description:

The YazLee Group secured $9,390,000 in proceeds for the cash out refinance of two multifamily properties totaling 80 units in Los Angeles. The loans are fixed for a 5 year term and offer 2 years of Interest Only payments. Since acquisition, the Borrower has renovated 46 out of 80 units, released them at higher rents, and added RUBS and laundry income. The selected lender was able to give the Borrower maximum credit for improving net operating income. The Lender was also able to underwrite vacant units at market rent. Although one of the properties required flood insurance, the excess premium had little effect on loan proceeds. The Properties are of masonry construction, but a property condition report confirmed that no earthquake insurance was required. The Lender was able to meet the Borrower’s goal of closing by year end.

|

|

|

|

Rate: 6.9%

Term: 12 Months

Amortization: Interest Only

LTV: 65%

Prepayment: None

Guarantee: Non-recourse

Lender Fee: 1%

|

|

Transaction Description:

GSP placed a 65% LTV refinance of an 87 unit multifamily property in Los Angeles. The Sponsor needed to pull cash out within 5 days to purchase a new opportunity. The Property had just been renovated to add retail space which has yet to be leased. GSP quickly identified a relationship capital provider who was comfortable with the Property and could close within 5 days on a sizable multifamily property with vacant retail. This type of transaction would usually also have a higher interest rate, but because of GSP’s relationship we were able to lock in 6.9% for 1 year.

|

|

|

|

GSP is working with a capital provider that will provide recourse fixed rate financing to 75% of cost (90% + on build to suits) including, acquisition, improvements, development, pre-development, discounted payoffs, bankruptcy exit, purchase of notes and cash-out. Fixed rate pricing starts at 9% for terms up to 1 year with extension options up to 3 years for Multifamily, Office, Industrial, Retail, Special-Use, Entitled Land and Construction. Loan sizes range from $1,000,000 to $10,000,000 for transactions located in California, Arizona, Nevada, New Mexico and Washington.

|

|

|

Was anyone watching the congressional hearing testimony from Fed Chair Powell or US Trade Representative Lighthizer? Powell highlights: Policy is “in the range of neutral”. Wow, the turnaround is complete on “where we are”. Remember early October when he spooked markets by saying we are “a long way from neutral”? Note that the Fed Funds rate was 2.25% at that time, speculation was the target neutral rate was somewhere between 3.25-3.50%, so the expectation was for at least 4 more hikes in the next year or two. Now, we are “there” which indicates the Fed feels no urgency to hike and is watching the data (unemployment and inflation). But today also showed a subtle shift in Fed concerns: financial market volatility, not usually a part of the stated Fed mandate. As Bloomberg pointed out, this concern for market stability is reminiscent of the “Greenspan put”. These developments are contributing to overall bullishness in Treasuries, the 10 year T is at 2.67%. Meanwhile, across the hall, Trade Representative Lighthizer tamped down some of the recent anticipation of an imminent trade deal with China, which was heightened in recent weeks with the extension of the March 1 tarriff deadline and talk of a signing ceremony in the US soon. He indicated hurdles remain, so it may be a while. This “bad news” of course helps the contrarian bond market. Stay tuned. By David R. Pascale, Jr. , Senior Vice President at George Smith Partners

|

|

|

If you have an inquiry regarding George Smith Partners’ commercial real estate financing, please contact your GSP representative or Todd August, Chief Operating Officer (310) 867-2995 or TAugust@GSPartners.com

|

|

Constellation Place

10250 Constellation Blvd., Ste. 2700

Los Angeles, CA 90067

|

|

|

|

© 1999 - 2024 George Smith Partners, Inc. DRE # 00822654 FINfacts is an ePublication of George Smith Partners, Inc. For Promotional Purposes Only. All Rights Reserved.

|

|

|

|

Hi, just a reminder that you're receiving this email because you have expressed an interest in George Smith Partners. Don't forget to add finfacts@gspartners.com to your address book so we'll be sure to land in your inbox!

|

|