Rate: 2.9% Fixed

Term: 10 Years, Interest Only

LTV: 65%

Prepayment: Yield Maintenance

Lender Fee: .5%

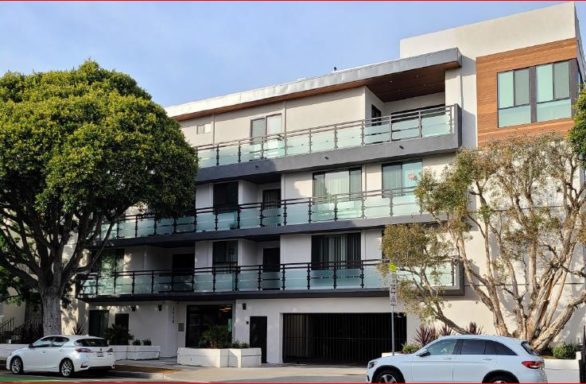

Transaction Description:

George Smith Partners secured a $7,986,000 first mortgage at 65% LTV for a 23-unit multifamily property in West Los Angeles, CA. The loan is non-recourse and supplies significant cash-out proceeds, a low 2.9% 10-year fixed rate, and full-term interest-only payments. The financing replaced a bridge loan that was put in place to acquire the Property and complete significant upgrades including unit renovations, common area and exterior improvements, and conversion to solar power.

GSP started working on the refinancing in the Spring of 2020 at the height of the COVID-19 quarantine, while the property was still being renovated and released. GSP was able to persuade the Lender to underwrite income on a trailing one month basis rather than a trailing six month basis. This allowed the underwriter to include the higher income from the newly leased units. The loan application process began when the property was approximately 75% leased. The lender agreed to a forward rate lock at 85% occupancy and closed when the building reached 95% occupancy.

Advisors

Related Financings

-

$9,425,000 Refinance Loan For 40-Unit Multifamily Property in Los Angeles, CA; 10 Years Fixed at 3.25%; Full Term Interest Only Payments

March 9, 2022

Transaction Description:

George Smith Partners arranged $9,425,000 in financing for the refinance of a stabilized 40-unit property located in Los Angeles, California. The loan is fixed at a rate of 3.25% for 10 years. The loan was a takeout of the acquisition loan that GSP closed five years earlier. Over the course of their ownership, the Sponsor performed a complete renovation of the property which included adding additional units. The loan provided a significant amount of cash out. It was closed with a regional bank and includes 10 years of Interest Only payments. Full term IO is rare for a bank loan and is more often found with CMBS loans, which have an expensive prepay structure. In this case, the bank’s declining prepay will allow the borrower flexibility to sell or refinance again depending on market conditions.

Rate: Fixed at 3.25% for 10 years

Term: 10 years

Amortization: Full Term Interest Only

Prepayment Penalty: 5,5,4,3,2,1,1,1,1%

Guaranty: Non-Recourse- Advisors: Matthew Kirisits

-

$4,200,000 Refinance of Luxury Condominium; Beverly Hills Adjacent, CA

November 29, 2021

Transaction Description:

George Smith Partners arranged a $4,200,000 loan collateralized by a three-story, luxury condominium located adjacent to Beverly Hills, CA. The Property had three recorded notes with the 2nd trust deed already in maturity default. GSP used its strong lender relationships to source a quick close solution to refinance two of the three notes with a new short-term loan that required the 3rd trust deed to subordinate to the new lender.

Rate: 6.4% Fixed, Interest-Only

Term: 1 Year

LTV: 63%

Prepayment: None

Guaranty: Non-Recourse

Lender Fee: 1% -

$9,882,000 Refinance for 32-Unit Multifamily Property, 3.49% For 10 Years, 6 Years Interest-Only; Los Angeles, CA

November 17, 2021

Transaction Description:

George Smith Partners secured $9,882,000 in proceeds for the refinance of a newly stabilized 32-unit property in the Palms neighborhood of Los Angeles. The loan is fixed at a rate of 3.49% for 10 years, with 6 years of interest-only payments. The loan is non-recourse and has no payment reserves.

Several challenges were encountered when discussing the transaction with capital providers. The Property had just reached stabilization, so GSP had to find a lender that would include the income from newly signed leases without requiring several months of operating history. The Sponsor desired to lock their low rate for 10 years. This eliminated bank financing as an option because banks price up for longer term loans. Some CMBS lenders offered very competitive rates, but the Sponsor wanted an easy and low-cost closing process. As a result, Agency financing was the best option for a 10-year fixed rate loan with partial term on interest-only payments. While in application, extensive data from comparable properties was used to support proforma expenses and maintain underwritten cash flow. The loan closed in about 60 days.

Rate: 3.49% fixed for 10 years

Amortization: 6 years Interest Only followed by 30 year amortization

Prepayment Penalty: Yield Maintenance

LTV: 65%

DCR: 1.25x

Guaranty: Non-Recourse- Advisors: Matthew Kirisits

-

$25,818,000 Bridge Loan Refinance of Vacant 51-Unit Multifamily Property; 85% LTV;5.2% Stabilized Debt Yield; Los Angeles, CA

September 1, 2021

Transaction Description:

George Smith Partners secured $25,818,000 in proceeds for the cash-neutral bridge loan refinance of a 51-unit multifamily property in Los Angeles. The Lender provided proceeds of 85% of appraised value and underwrote to a 5.2% stabilized debt yield. The new loan refinances both the construction loan and the preferred equity that were part of the original financing. The loan is floating at LIBOR + 6.00% with a 6.65% floor.

At the time of financing the Property was 95% complete but still short of a temporary certificate of occupancy. In addition, the leverage on the loan precluded several lending sources from achieving the necessary proceeds. The Sponsor desired to completely pay off the original construction financing, which was originated at 85% loan to cost. Only a few lenders could get the requested leverage and the market quoted pricing in the high single digits. Lastly, Koreatown experienced Covid related collection issues which affected the rental underwriting. GSP provided rental and sales comps that proved out the strength of the market. As a result, the selected Lender became comfortable with the location and the Sponsor’s ability to lease up the new Property.

Rate: Floating at LIBOR+6.00% with floor of 6.65%

Term: 12 months + one 12-month extension

LTV: 85%

Debt Yield: 5.2%

Guaranty: Non-Recourse at Certificate of Occupancy- Advisors: Matthew Kirisits

-

$12,083,000 Non-Recourse Cash-Out Agency Refinance for Multifamily Property; Western States

June 16, 2021

Transaction Description:

George Smith Partners successfully arranged the cash-out refinance of a 200+ unit multifamily property. The loan is floating at a starting rate of 2.56% and allows the Sponsor to complete a value-add strategy to increase the NOI and refinance into a permanent loan at higher proceeds in 18-24 months.

While processing the loan, GSP worked with the Lender to understand the historical cash flow which was extremely choppy due to the inconsistent rent payments during the Covid-19 pandemic. The analysis resulted in a $3,000,000 increase to the loan amount and an additional year of interest only payments.

Rate: 2.55% + SOFR

Term: 7 Years

LTV: 65%

Amortization: 3 Years Interest Only, 30 Year Am Thereafter

Prepayment: 1-Year Lockout, then 1%

Guaranty: Non-Recourse -

Perm Debt – 10-Years Interest Only – Stabilized Multifamily; Los Angeles, CA

March 24, 2021

Transaction Description:

George Smith Partners secured senior permanent financing for a stabilized multifamily property in Los Angeles, CA. The non-recourse debt totaling $12,300,000 was utilized to refinance existing debt and return equity to the Ownership. The loan was structured with a 10-year term and interest only payments for the full duration. The loan was collateralized by a Class-A 34-Unit multifamily building, the Subject was 94% leased at closing and located in a highly desirable West Los Angeles neighborhood.

GSP selected a lender that was able to refinance the Sponsor’s existing debt, cover prepayment penalties and return a significant amount of equity to the Borrower, while simultaneously locking in interest only payments for the next ten years at a very desirable rate. GSP worked with the Lender to minimize debt service reserves while addressing Lender concerns for potential COVID related shortfalls; cash-out proceeds were secured on the loan despite several COVID related delinquencies.

Rate: 3.43%

Term: 10 years

Max LTV: 65%

Min DCR: 1.35x

Amortization: None; 10-Years Interest Only

Origination Fee: Par

Prepayment: Yield Maintenance- Advisors: Matthew Kirisits