Rate: LIBOR + 400

Term: Two Years + 1 Six Month Option

LTC: 70%

LTV: 60%

Guaranty: Recourse

Transaction Description:

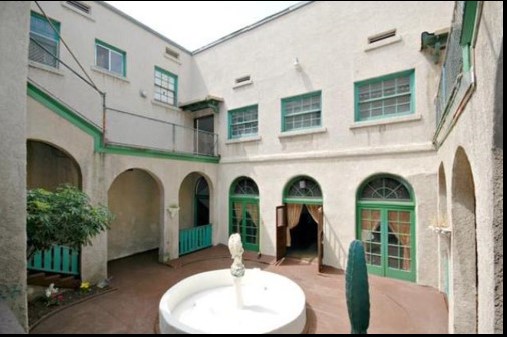

George Smith Partners placed a $4,900,000 construction loan for a shuttered assisted living facility to be converted to a 42 bed co-living facility targeted toward young working professionals. As rental housing prices continue their rise many developers are addressing affordability with smaller units that offer common living amenities to maintain lower costs. The co-living concept of a singular bed/unit is popular in New York, Seattle, San Francisco and has a strong foot-hold in the Hollywood market of Los Angeles. Located adjacent to Downtown Los Angeles, the Subject Property proved challenging to comp as it is not located in Hollywood and co-living is a new concept in this market. Partially or fully furnished bedroom units are supported by a central communal kitchen. Some units will share a bath. Utilities are provided, including heat, cable and WiFi allowing residents to move-in with simplicity and ease. Social connections are encouraged through property gatherings and a movie room. A business center will also be offered to residents. This is the first co-living development for this sponsorship team. Priced at L+400, the two-year term was constrained by 70% of capitalization and 60% of “As-Stabilized” value. There is a six month option to extend for an additional 50 basis points.

Advisors

Related Financings

-

Acquisition Bridge Loan for a Newly Constructed 10-Unit Multifamily Property in Florida

April 4, 2024

Transaction Description:

George Smith Partners sourced an acquisition loan for a newly constructed 10-unit multifamily property in Florida. The borrower closed on the vacant property just after Certificate of Occupancy was received. Although the loan went into application several months ago, the seller was delayed in obtaining the C of O. Despite fluctuations in the capital markets, the lender held the fixed rate of 10.25%. The loan has a 9-month term with one 3-month extension option. A small interest reserve was structured to cover the initial payments while the property leases up.

Rate: 10.25% fixed

Term: 9 months with one 3 month extension

Origination Fee: 1%

Guaranty: Non-Recourse

- Advisors: Matthew Kirisits

-

$23,500,000 Construction Financing for a 136,000 SF Industrial Park in a Southwestern State

March 21, 2024

Transaction Description:

George Smith Partners successfully arranged $23,500,000 in construction financing for the development of a 136,000 SF industrial park in a Southwestern State. The development includes two free standing buildings that can be programmed for manufacturing, distribution, or other industrial use, and is ideal for owner-users or single-user tenants.

The capitalization included land that had been owned free and clear for over two decades and contributed to the deal as Sponsor equity. GSP identified a lender that understood the land contribution and spec development elements of the deal. As well as the unique positioning of the two buildings as an underserved, small-scale, free-standing product in the State’s industrial market.

Terms: Not Disclosed

- Advisors: Brandon Asherian Grant Pugatch

-

$42,120,000 Stretch Construction Financing for a 188-Unit Build-for-Rent Site in Raleigh/Durham, North Carolina

February 1, 2024

Transaction Details:

George Smith Partners has successfully arranged a non-recourse stretch senior construction loan of $42,120,000 for the ground-up construction of a 188-unit build-for-rent community in Raleigh/Durham, NC. George Smith Partners, through their expertise in build-for-rent communities and strong relationships with a multitude of lenders was able to negotiate favorable terms for the sponsor including a sizable land lift. The sponsor self-performed most of the site improvements and partnered with a home builder to erect the townhomes on the finished lots in tranches of 15-20 per month. The loan was priced at a floating rate of SOFR plus 475bps with one 6-month extension option. When built, the project will provide the future occupants from the rapidly growing market of Durham a mix of three and four-bedroom townhomes with two-car garages, an amenity center, access to top school districts, and proximity to high income tech jobs.

Loan Amount: $42,120,000

Loan-to-Cost: 75% LTC

Spread: 4.75%

Index: 1-Month SOFR

Guaranty: Non-Recourse

- Advisors: Ed Steffelin Evan Kinne Jordan Lipton Nick Shapiro

-

$14,100,000 Horizontal Land Construction Financing for 98-Single Family Residential Lots; Homestead, Florida

November 15, 2023

Transaction Description:

George Smith Partners has secured $14,100,000 in funding in support of our Sponsor’s horizontal construction of 98-single-family lots in Homestead, FL. The allocated funds are intended to finance the essential infrastructure for the forthcoming single-family residential community. The lots will be sold in stages to a predetermined homebuilder. Our Sponsor has obtained a revolving loan of 60% LTC, which features a floating rate of Prime + 50, spanning a 24-month term.

Term: 2 Years with Extension Options

Rate: Prime + 50

LTC: 60%

Guaranty: Non-Recourse- Advisors: Justin Piasecki Thomas Butler

-

$14,000,000 Construction Financing for a 110,929 SF Industrial Project; Western State

October 18, 2023

Transaction Description:

George Smith Partners secured $14,000,000 in construction financing for an industrial project in a western state. The project is a 110,929 SF, 100% spec industrial development in an attractive industrial submarket.

GSP canvassed banks, credit unions, and debt funds to find a lender that was comfortable with the business plan, which included no preleasing before construction. GSP worked with the Lender and Borrower to structure a loan which provided 65% of the costs to construct, lease, and stabilize the building. As well as a term of 30 months to provide sufficient time to complete the lease-up after completion of construction. The loan was also structured to provide an upsized 10 year perm loan option upon stabilization.

During structuring negotiations, the Lender acquired a competitor and there were market rumors that they were suspending all lending to digest the acquisition. GSP diligenced the market and arranged supplemental calls with the Lender and the Borrower- resulting in the Borrower having well-placed confidence that the loan would not only close but also on the quoted terms.

Rate: SOFR + 3%

Term: 30 Months with an option for an upsized 10 Year Perm Loan

Amortization: Interest Only

Guaranty: Recourse with Burnoff upon Achieving Performance Hurdles- Advisors: Matthew Kirisits

-

$4,835,000 Pre-Development Bridge Financing for 205-Unit Multifamily Project; Denver, CO

August 30, 2023

Transaction Description:

George Smith Partners successfully secured a $4,835,000, 72% LTC, fixed, non-recourse, pre-development bridge loan for a 205-unit multifamily ground-up construction project in Denver, Colorado. The bridge loan will be used to complete all the architecture/engineering milestones required to obtain permits and finalize pre-development work prior to breaking ground in Q3 of 2024.

The Denver metropolitan area is expected to add roughly 216,700 new residents over the next five years, fueled by the expansions of the Denver International Airport and Fitzsimons Medical Campus. The Project is expected to fulfill an underserved workforce demographic by offering an affordable yet high-quality option. The Project will feature a rooftop deck with BBQ grills, outdoor games, picnic areas, a dog run, gym, state-of-the-art security systems, bike parking, package storage, and a mail center with full-time onsite management and maintenance.

Term: 14 Months

Interest: Fixed

Extensions: Two 3 Month Extensions

LTC: 72%

Guaranty: Non-Recourse