-

Gary M. Tenzer Participates in Commercial Real Estate Symposium Panel

October 5, 2018

The Real Property Law Section held their annual Commercial Real Estate Symposium on Thursday, October 4, 2018. Gary M. Tenzer, Principal/Co-Founder of George Smith Partners, participated in a panel that discussed the trends and developments of real estate financing in 2018. The panelists included Caroline Dreyfus of Cox, Castle & Nicholson, Mitchell Regenstreif of DLA Piper, and David Hitchcock of Buchalter.

Gary described current trends in commercial lending, in which he covered rising interest rates, pull-back in construction financing, and how non-recourse loans are much more common now than a year ago. In addition, he dove into the lending activity of the agencies and life insurance companies. The panel concluded with a discussion of specific financing topics and loan provisions such as non-recourse carve-outs, permitted transfers, preferred equity rights, and financial covenants.

-

Jonathan Lee Moderates Panel Discussion at Interface Las Vegas Multifamily Conference

April 26, 2018

Jonathan Lee moderated the discussion for the Capital Markets panel at the Interface Las Vegas Multifamily Conference on Tuesday, April 24th, 2018. The panelists included: Gary Bechtel of Money 360, Dan Gaylord of ReadyCap, Scott Monroe of NorthMarq Capital and Cheryl Colbus of U.S. Bank.

The discussion focused on the construction of new multi-family projects and the current appetite in the Greater Las Vegas MSA. Bridge (Value Add) and Permanent financing were areas of conversation.

-

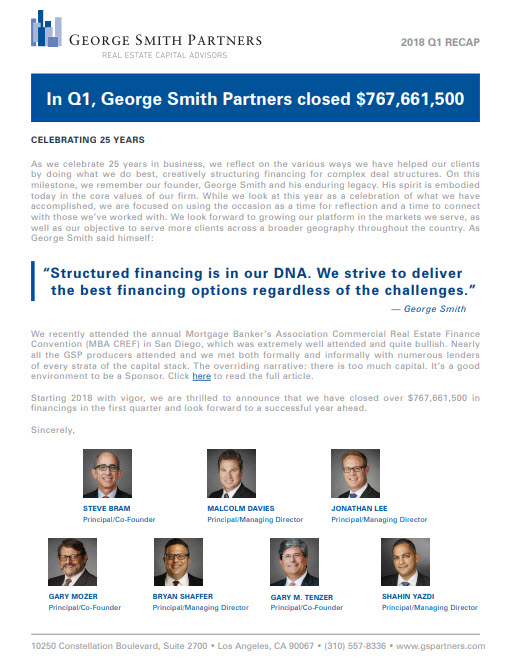

2018 Q1 Recap

April 23, 2018

-

Report from 2018 MBA CREF

February 14, 2018

This week’s annual Mortgage Banker’s Association Commercial Real Estate Finance Convention (MBA CREF) in San Diego was extremely well attended and quite bullish. Nearly all the GSP producers attended, we met formally or informally with several lenders of every strata of the capital stack. The overriding narrative: too much capital chasing not enough deals. It’s a good environment for sponsors with transactions that make sense. First off: Credit spreads are narrowing as indexes rise, keeping all in rates relatively low. Bridge Lenders: Unregulated debt funds are dropping spreads as investor appetite for Collateralized Loan Obligations (securitization vehicles for floating rate debt) is high. Other executions include funds doing portfolio lending using bank lines, mortgage REITs, etc. Virtually all lenders in this field are non-recourse. Negative cash flowing transactions, empty buildings, heavy renovations are all financeable at good leverage and terms. Mezzanine and Preferred Equity: Again, the cost of capital is coming down with healthy competition: sub-debt is available for cash flowing stabilized assets (behind fixed rate CMBS or Life Company), bridge, construction. Pricing can be as low as single digit coupons. Many senior lenders of all types are open to sub-debt with pre-negotiated intercreditor agreements, etc. CMBS: Spreads are tightening as supply is dropping (note that the massive volume of 10 year maturities ended in 2017 as 2008 was a dead year). Low leverage is pricing as low as Swap + 130, today that is 4.22% even with the spike in Treasuries. Full leverage loans are pricing about 160 to 180 over, coupons in the 4.50-4.75% range. Lenders are wary of retail, but many are bullish on the classic “daily needs” local shopping centers. Tenant sales really help, but are not necessary. Life Companies: Large allocations, lower leverage, lock rate at application, all in rates about 4.50%. Banks: Hoping for some deregulation, competing on perms with tight spreads (especially for 5-7 year fixed rate). Still funding construction loans depending on the individual banks portfolio, burn off, reserves, etc. There is some concern about overbuilding in certain markets.Credit Unions: Very active, fixed rate with no prepayment, usually requiring recourse.

Don't Miss a Fact,

Sign Up for FINfacts!

FINfacts is a weekly newsletter highlighting recent financings and economic insights.

Subscribe Here