-

Talk: Powell Gives Semi Tough Remarks at 2024’s First Fed Meeting…Data: Markets Rally on Signs of Labor Slack

February 1, 2024

After the November/December rate rally that saw the 10-year Treasury drop from near 5.00% to 3.79%, 2024 started with a partial reversal as the 10-year spiked to 4.18% in mid-January. It seemed like markets had “gotten ahead of themselves” with the rally and some correction was in order. December’s PCE report showed strong consumer spending (up 0.7% in December), but the spending was not matched by income growth. Rising credit card balances and lower personal savings rates fueled the holiday splurge, implying it is ultimately unsustainable. Annual Core PCE showed a 2.9% increase, still above the Fed’s 2% target. The 3-month moving average is 1.5% annualized and the 6 month is 1.9%.

Yesterday’s Fed announcement left rates unchanged as expected, all the action is in the statement and Powell’s presser. The statement was simultaneously dovish (it removed language about the Fed’s willingness to keep raising rates) and tamping down expectations (no plans to cut rates with inflation running above the Fed’s target). The current data indicates that we might be there now, but the Fed is still haunted by the early 80s “whoops, we cut too soon and had to raise again” rollercoaster. So, Powell dutifully remarked that “rates are still too high” and that a March rate cut was not likely. Future markets adjusted and now indicate a 95% chance of a rate cut on May 1 (90 days from today but who is counting?). Powell indicated the Fed is “data dependent” and “meeting by meeting.” More semi dovish talk from Powell, “The committee intends to move carefully as we consider when to begin to dial back the restrictive stance that we have in place.”

This week’s data indicated that time is coming; higher jobless claims, higher worker productivity (employer wage dollars being stretched), lower ADP payroll growth, etc. These are signs of long awaited “labor slack” which is closely watched by the Fed. The 10-year Treasury has rallied from 4.13% to 3.85% this week. CMBS spreads are compressing as bond buyers return with fresh allocations and a bullish rate sentiment. All eyes will be on tomorrow’s January employment report. Will the “slack” continue? Stay tuned…

By David R. Pascale, Jr., Senior Vice President at George Smith Partners.

-

Fed Raises Rates by 0.75%, Biggest Increase Since 1994

June 15, 2022

“Seinfeld” was a must-see show on TV and “Forrest Gump” was packing cinemas back when Fed Chair Greenspan raised rates by 0.75% in November of 1994. Today’s rate increase was expected after last Friday’s CPI report of 8.6% overall, with a 6.0% jump in core inflation. The news broke Monday and was confirmed by many bank analysts. This led to a huge jump in the 10-Year Treasury from about 3.04% (Friday morning) to as high as 3.50% (Yesterday). Stock markets plunged with the Dow losing about 10% of its value in the last week.

Today’s Fed announcement and press conference by Fed Chair Powell, while hawkish, actually calmed markets. Why? It was a case of “Sell the rumor, buy the news.” Stock markets rose and the bond market rallied – the 10-Year dropped to 3.29%. Markets see a Fed that is determined to fight inflation and Powell provided more clarity on the future. Markets were in free fall largely due to the uncertainty of monetary policy going forward. Today, Powell and his colleagues helped assuage those concerns with the following comments: (1) The planned increase at next month’s meeting will be “50 or 75 basis points” (so a 75 bp increase is not “for sure”), (2) “75 bp increase is a large one, and I do not expect moves like this to be common”, (3) Predictions from the Fed: the Fed Fund’s target rate for year end 2022 is 3.4% (note that this estimate was 1.9% in March) and 3.8% for year-end 2023, before tapering down to 2.4% – the neutral rate. The Fed Funds rate is at 1.50% – 1.75%, 30-Day SOFR is 1.48%, and 30-Day LIBOR is 1.50%. Sign of the Times: “Collars” are back. Interest rate caps are now also being offered with a “collar” that can alleviate costs. The cap purchaser also “sells a floor” to the cap provider by agreeing to pay a minimum interest rate if rates drop. Stay tuned…

By David R. Pascale, Jr. , Senior Vice President at George Smith Partners

-

Treasury Yields Drop As Markets Wait for CPI

June 9, 2021

Economists are expecting tomorrow’s CPI report to show a 4.7% increase from a year earlier. Today saw the 10 year treasury yield drop to as low as 1.47%, possibly due to technical short covering in the markets. The big question is – will tomorrow’s big number rattle Treasuries into a sell-off? Or, will the number be tamer than anticipated? Last week’s weaker than expected jobs report calmed market inflation expectations. Tomorrow’s report may rekindle inflation fears.

Spotlight on Hospitality: During the depths of the pandemic shutdowns in 2020, the hotel industry was hit hard, many hotels were closed for business or operating at severely reduced capacity. The monthly occupancy rate plunged from 62% in February to a multi-decade low of 22% in April. Many market participants were anticipating a wave of distressed property acquisition opportunities in the sector stemming from lender foreclosures. The “wave of distress” did not occur. The pandemic shutdown was vastly different from the credit crisis and Great Recession that began in 2008. This time, vaccine distribution and the 2021 reopening of society was within sight. Most lenders allowed their borrowers to hold on through the crisis. Case in point: the largest distressed portfolio in the US, the Eagle Hospitality Trust included 15 hotels located across the country. The distress in the portfolio stemmed from ownership issues then exacerbated by the pandemic. The auction is going better than anticipated with 5 assets fetching prices in excess of the stalking horse bids and the remaining assets expected to be sold this month. According to STR, May 2021 US Hotel occupancy hit 61.8%. Memorial Day weekend occupancy was nearly 80%. CMBS Hotel loans in special servicing dropped to a pandemic era low of 20.1%, after hitting a high of 26% last summer. Last month’s jobs report indicated that Leisure and Hospitality led the net increases in jobs at 331,000 new hires (#2, Government was at 48,000). Business travel is showing signs of life and even pent up demand. This week, the first major convention post pandemic, the World of Concrete in Las Vegas is well attended. Corporate travel is starting up amongst companies looking to get an edge on their competitors still doing business remotely. Here at GSP we are seeing more capital sources now considering hotel loans albeit at lower proceeds and higher risk spreads, but it’s a start. Stay tuned. By David R. Pascale, Jr. , Senior Vice President at George Smith Partners

-

$44,500,000 Heavy Bridge Construction Financing to Add Several Uses to an Existing Office and Warehouse; Secondary Market; San Luis Obispo, CA

April 19, 2021

Transaction Description:

George Smith Partners arranged $44,500,000 for heavy bridge financing in San Louis Obispo, CA to recapitalize and fund construction for additional uses on an existing asset. The completed Project will include five uses including multifamily, warehouse, office, self-storage, and a brewery. This is among the largest private projects actively in development in the local market.

The Sponsor has been very creative in obtaining the highest and best use for the asset in a supply constrained market. Despite challenges facing construction projects in today’s volatile commodity market, GSP was able to secure a capital provider to structure high leverage supported by the strong market and underwriting. -

Mezzanine and Preferred Equity Up to 90% LTV

April 24, 2019

George Smith Partners is working with a national lender offering preferred equity programs for all property types ranging from $15,000,000 to $50,000,000 in primary and secondary markets. With the ability to advance 90% of purchase price for Mezzanine and Preferred Equity, pricing starts at LIBOR + 600 with floating rates up to five years. The lender offers a flexible prepayment structure and future funding.

-

Non-Recourse Bridge & Mezzanine Financing up to 85% LTV

April 10, 2019

George Smith Partners is working with a national capital provider funding non-recourse bridge and mezzanine debt to 85% of value. The Lender offers flexible loan structures with interest only terms up to 6 years (inclusive of extension options) for transactions from $10,000,000 to $75,000,000. Floating rate pricing starts at LIBOR + 275. The Lender has a strong appetite for Multifamily, Office, Industrial, Retail and Hospitality properties located in primary, secondary and tertiary markets.

-

Shannon Bradley Celebrates 26 Years at GSP!

September 25, 2018

Shannon Bradley celebrates her 26 year anniversary at GSP. Shannon has so many great memories it is hard to pin point one in particular. GSP is like home to Shannon having worked for the firm for over half of her life. Shannon says, “George would be proud to know that the same sense of family he brought to the firm still exists today”.

-

Jonathan Lee Discusses Key Takeaways From PCBC 2018

July 13, 2018

PCBC 2018 wrapped in San Francisco Friday before the July 4th week. Overall sentiment from homebuilders was bullish, while multi-family operators saw market headwinds and existential threats. Some topic overviews and takeaways included 1) economic and market outlook 2) the components of equity today 3) rent control. On the economic front, developers across the board witnessed price appreciation but slower growth on the wage side, which is starting to cap home prices and limit rents. Prices have reached peak affordability in most major MSA’s. Millennials are starting to buy small condos, to the extent they are available, as a hedge against rising rents. Interestingly land development is outpacing all investments right now, and has become the most desired asset class for several funds. From the equity fund perspective, fundraising in the United States is at an all-time high. Available capital for investment, including non-real estate classes, has exceeded $2 Trillion domestically. What real estate fund managers are receiving money to deploy? Those that have an above average track records and favorable fund terms. Number one concern of those fund managers is valuations and deal flow. More is being returned to LP’s because of record levels of available cash but deal flow remains low. Of the equity groups who are actively deploying LP capital, market perception is mixed. According to a recent Prequin survey, 50% of equity fund managers think real estate is at its peak. The main driver of fear is no longer a global recession, but the rise in interest rates and the US domestic political environment. Return expectations have also fallen. Where expectations were a 20% IRR in 2015, today 17% is becoming the new norm. LP Groups are actively seeking Sponsors who have focus and control over subs. Focus should be on one project or a single thesis. If an opportunity doesn’t fit a particular equity group, don’t ask about second and third deal in your pipeline. Sponsors who do this appear not focused and passionate about success. On the flip side, if a first project is a success then some LP’s are funding zero co-invest with a promote for repeat clients. Because labor is not showing up on jobs and thereby delaying projects, LP equity is looking for local expertise and influence over sub-contractors. Delays from labor not showing up on site push down yields, and Sponsors who can mitigate that risk are placed in a premium level. Lastly, new rent control legislation cast a looming shadow over the conference for developers. The California initiatives to repeal CostaHawkins was viewed as an existential threat to the multi-family real estate industry in California, more than mortgage rates, labor costs and entitlement challenges. If successful it will allow rent caps on property in perpetuity which will cap upside for new developments. It is possible the to be named measure went too far as it also puts single family homes under this new ordinance as well. The Achilles Heel could be forcing Mom and Pop owners of a single family home to cap their upside. On July 2, 2018 the ballot initiative gets a name/number and will be on ballot this Fall. Some final random musings: Driverless vehicles are rapidly changing parking for projects, but driverless trucks could displace 6 million workers by 2024. According to a survey completed by 278,000 renters in 44 states, the most important amenities tenants want in their units are: #1 in-unit washer/dryer, #2 dishwasher, #3 cell phone reception. When is the recession going to hit?!?!?! Happy to report that for the third straight year, the PCBC economist stated a recession isn’t expected for another 36 months.

-

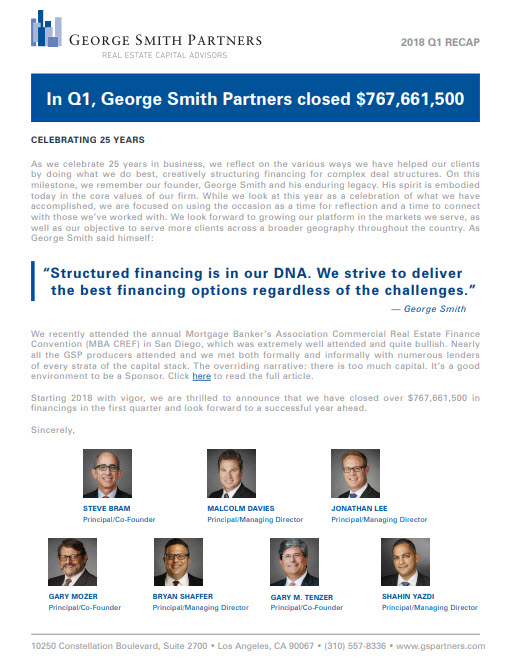

2018 Q1 Recap

April 23, 2018

-

Expert Witness Services

March 26, 2018

About 30 years ago, as a well-known real estate finance expert, George Smith was asked by an at-torney to serve as an expert witness in a real estate litigation; this lead to several more assignments in the next few years. George didn’t enjoy doing expert work and asked his young associate and fu-ture co-founder of GSP, Gary Tenzer, to help him prepare for his testimony. Over time, George de-cided not to take any new assignments and turned them all over to Gary. Gary enjoys arranging financing for his clients; but, unlike George, he also enjoys the intellectual challenge and pressures of being an expert witness in complex commercial real estate related litiga-tion matters. Over the past 25 years, Gary Tenzer has developed a national reputation as an expert witness in real estate finance litigation.

Gary has served as an expert witness in over 300 litigation matters and testified in over 100 trials in both Federal and State courts, nationwide. He has worked as an expert with some of the most well-known law firms in the country and with some very major litigations including serving as the interest rate expert on behalf of General Growth Properties (“GGP”) in their multi-property bankruptcy in 2009, reportedly the largest real estate Chapter 11 in history. Other well-known litigation clients have included Carmel Partners, Hard Rock Hotels, Simon Property Company and financial institutions such as J. P. Morgan, US Bancorp and Wells Fargo Bank. In addition to bankruptcy testimony, Tenzer has testified on disputes between borrowers and lenders, buyers and sellers, principals and investors, financial feasibility as well as a myriad of other real estate transactional and finance issues.

In future editions of “Finfacts”, we will include some feature articles from Gary sharing his insights into real estate litigation, from a non-lawyer’s point of view.

For further information about Gary Tenzer’s expert witness practice and to review his Curriculum Vitae, click here. -

Shahin Yazdi: Fifty Under 40

November 1, 2017

Shahin Yazdi, Principal & Managing Director has been nominated by Real Estate Forum for, “Fifty under 40” 2017. Shahin is the youngest Principal and Managing Director in George Smith Partners’ 25-year history. In just 10 years with the firm, Yazdi has arranged more than $1 billion in financing for commercial real estate transactions throughout the United States. Click here to read the full article.

-

Fixed Rate Non-Recourse Loans Up to 85%

October 11, 2017

George Smith Partners identified a national capital provider funding fixed or LIBOR-based floating rate loans from $3,000,000 to $75,000,000, starting at 4.5%. This lender will finance Multifamily, Retail, Office, Industrial, Self-Storage, Mobile Home Parks, and Hospitality properties located in primary and secondary markets nationwide. 30 year amortization and terms up to 10 years on a non-recourse basis up to 85% LTV.

Don't Miss a Fact,

Sign Up for FINfacts!

FINfacts is a weekly newsletter highlighting recent financings and economic insights.

Subscribe Here